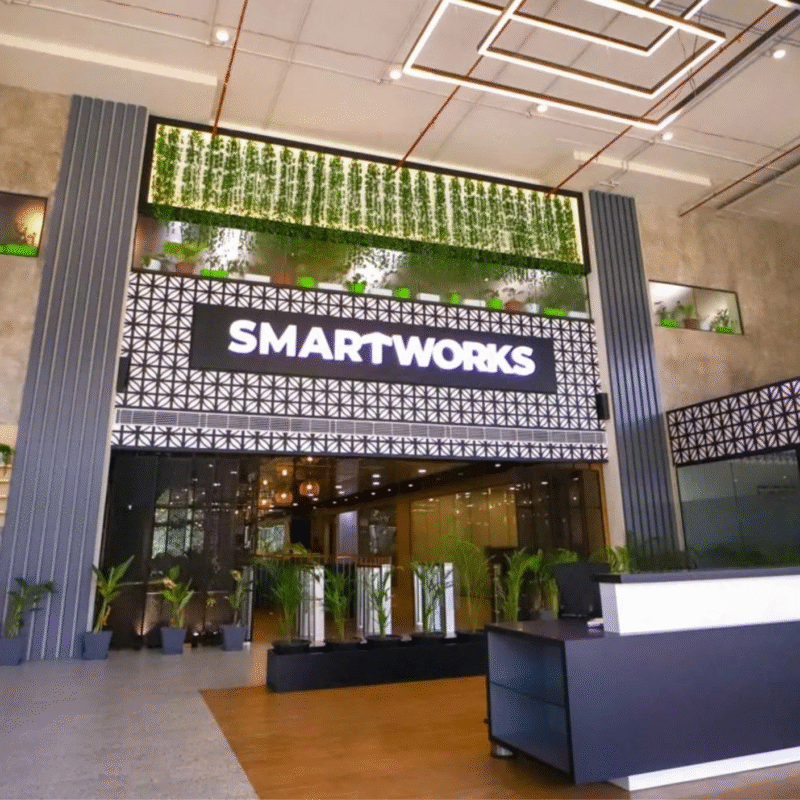

Smartworks Q1 FY26 Revenue Rises to ₹379.2 Crore

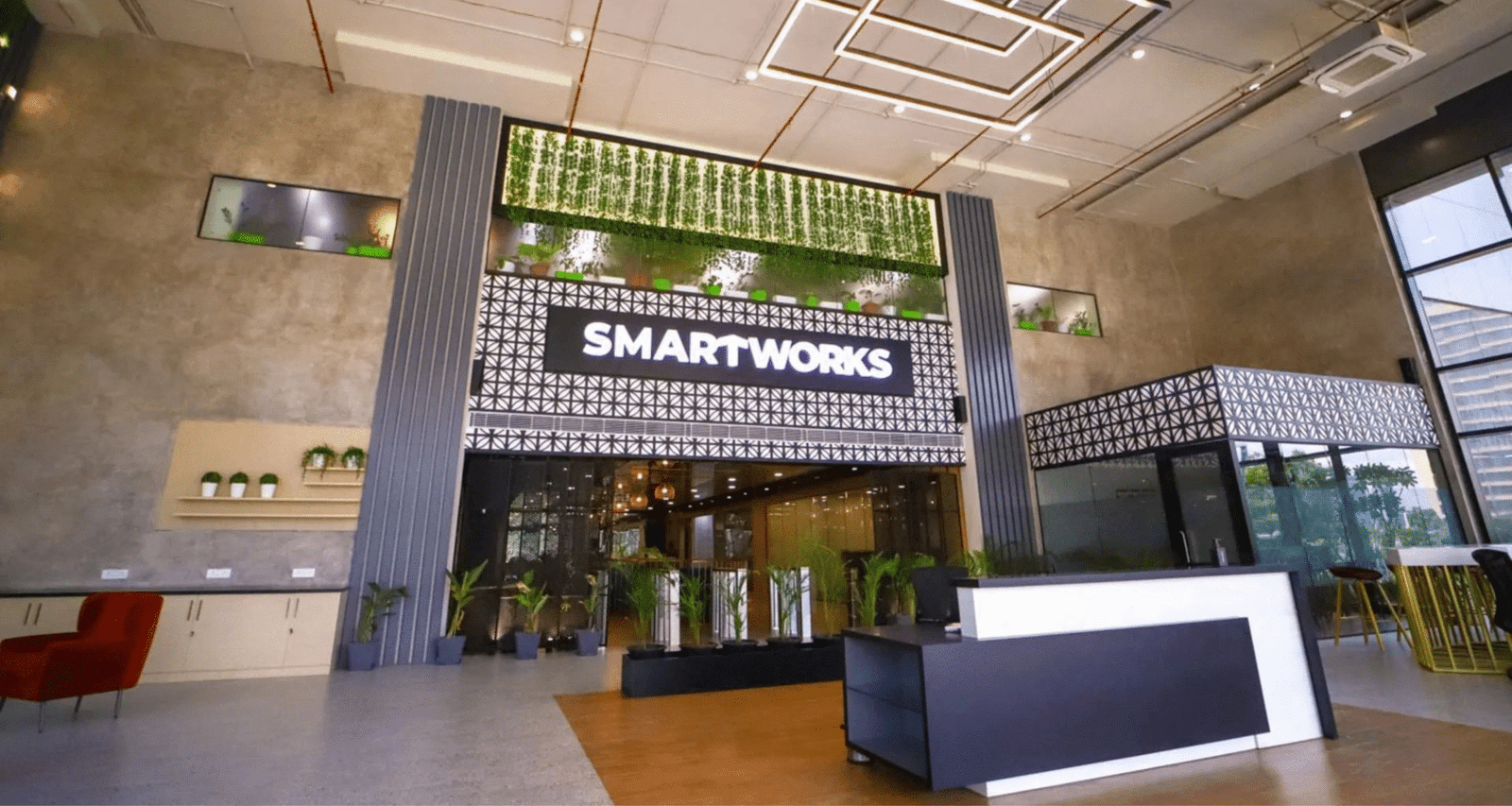

Smartworks Coworking Spaces Limited, touted as India’s largest managed office platform by total assets under management, has kicked off FY26 on a strong note. The company reported double-digit revenue growth, improved margins, and significant portfolio gains in the first quarter, marking a confident start to the year. Adding to the momentum, Smartworks made its market debut on the NSE and BSE on July 17, 2025.

For Q1 FY26, revenue from operations stood at ₹3,792 million. Much of the company’s recent portfolio expansion is expected to mature in the second half of the fiscal year, which is likely to further boost both revenue and profitability.

IND-AS EBITDA grew 25.5% year-on-year to ₹2,410 million, translating into a margin of 63.6%. On a normalised basis — after adjusting for accounting provisions — EBITDA surged 109% to ₹607 million, with a margin of roughly 16%. This performance was supported by disciplined cost management and operating leverage.

Normalised profit before tax rose to ₹168 million, reflecting a 4.4% margin, compared to a normalised loss of ₹102 million in Q1 FY25. On a reported basis, the PBT loss narrowed to ₹56 million from ₹311 million a year earlier. Normalised operating cash flow also jumped over 71% year-on-year to ₹855 million.

As of June 30, 2025, Smartworks’ portfolio covered 10.08 million sq. ft. of leased space, with 0.70 million sq. ft. under fit-out and 1.07 million sq. ft. scheduled for handover in Q2 and Q3. Including signed letters of intent, the total space under management is expected to reach about 12 million sq. ft.

Since FY19, the company has added 8.6 million sq. ft. across key cities such as Pune, Bengaluru, Hyderabad, and Mumbai. Operational centres currently maintain occupancy above 83%, with committed occupancy surpassing 89%. Enterprise clients account for 90.49% of the portfolio, and 32.91% of clients are multi-city engagements. The weighted average client tenure is 45 months, with an average lock-in period of 33 months. Debtor days remain under one week, highlighting strong payment collections.

Neetish Sarda, Managing Director of Smartworks, said the company has strengthened its presence in key markets by adding over 1 million sq. ft. of new supply, positioning itself to capture rising demand. He noted that normalised EBITDA doubled to ₹607 million in Q1 FY26 from ₹290 million in Q1 FY25, with margins improving from 9.3% to 16.0%.

Looking ahead, Sarda emphasised that Smartworks will continue leveraging its market presence in India and Singapore, along with its integrated service model, to drive sustainable growth and long-term value creation.

Harsh Binani, Executive Director, highlighted that operational momentum remains strong, supported by a premium portfolio and a healthy pipeline of upcoming supply. He revealed that the company now has over ₹40,000 million in committed revenue, ensuring strong visibility for future cash flows. Several marquee clients have joined the portfolio this quarter, reaffirming Smartworks’ position as a trusted workspace partner for enterprise India.

Binani also pointed out that over 90% of the company’s revenue comes from enterprise clients, with more than 30% from multi-city engagements. With 1.07 million sq. ft. scheduled for handover in the next two quarters, Smartworks expects to expand its footprint to nearly 12 million sq. ft. in FY26, further cementing its leadership in the segment.

Catering primarily to mid-to-large enterprises, Smartworks has built a diverse client base of over 700 organisations, including Fortune 500 companies, large corporates, MNCs, and startups. The company manages 10.08 million sq. ft. across 54 centres in 15 cities — including Bengaluru, Pune, Hyderabad, and Mumbai — as well as in Singapore, offering a total seating capacity of more than 230,000.